Modern Bookkeeping Automation in Germany

Navigating Complexities, Solutions, and the Future of Financial Record-Keeping

Navigating Complexities, Solutions, and the Future of Financial Record-Keeping

Germany's business landscape is known for its precision and thoroughness, qualities that extend into its financial record-keeping requirements. With some of Europe's most rigorous accounting standards, German businesses face unique challenges in modernizing their bookkeeping processes while maintaining strict compliance with national regulations.

German bookkeeping (Buchführung) is characterized by meticulous requirements that present several notable challenges for businesses:

German accounting practices are governed by multiple regulatory frameworks including the German Commercial Code (Handelsgesetzbuch, HGB), tax legislation (Abgabenordnung), and principles of proper accounting (Grundsätze ordnungsmäßiger Buchführung, GoB). Additionally, the GoBD (Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff) specifies detailed requirements for electronic record-keeping.

German tax authorities require extensive documentation for all business transactions. Every entry must be verifiable with original supporting documents (Belege), creating a significant administrative burden. These documents must be stored for 10 years, with strict guidelines on how electronic records must be maintained.

Germany's Value Added Tax (Umsatzsteuer) system involves multiple tax rates and complex rules for different transaction types. Proper accounting for VAT, including the correct application of reverse charge mechanisms for cross-border transactions, presents considerable challenges.

German businesses face numerous reporting deadlines, including monthly or quarterly advance VAT returns (Umsatzsteuervoranmeldung), annual tax returns, and for larger companies, extensive annual financial statements that comply with both national and potentially international standards.

While Germany has a reputation for technological advancement in many sectors, the adoption of bookkeeping automation has been somewhat cautious, primarily due to regulatory concerns and traditional business practices. However, the landscape is evolving rapidly:

This varied adoption rate creates a distinct digital divide in financial processing efficiency across the German business landscape. Companies that have embraced automation report significant improvements in accuracy and processing time, while those relying on manual processes continue to struggle with administrative burdens.

The German market offers a range of bookkeeping automation solutions that address various aspects of the financial workflow:

Solutions like DATEV, Lexware, and SAP Business One dominate the market with comprehensive packages specifically designed for German accounting requirements. These systems excel at maintaining compliance with German regulations but often require significant investment and training.

Effectiveness: High for compliance, moderate for efficiency

Platforms like Sage One, sevDesk, and lexoffice offer cloud-based alternatives with modern interfaces and subscription models. While gaining popularity for their accessibility and user-friendly design, these solutions sometimes struggle with the full scope of complex German compliance requirements.

Effectiveness: Moderate for compliance, good for small business efficiency

Solutions focused on digitizing paper documents have become increasingly important. Traditional OCR tools offer basic text extraction but struggle with complex document formats and variable layouts common in German invoices and receipts.

Effectiveness: Low to moderate, depending on document complexity

Advanced platforms like Eagle Doc use artificial intelligence to extract data from financial documents with high accuracy regardless of format variations. These solutions can recognize German-specific document formats, tax rates, and regulatory information.

Effectiveness: High for both accuracy and efficiency

The effectiveness of bookkeeping automation solutions in Germany varies significantly across different aspects of the financial workflow:

| Process Area | Automation Level | Key Challenges | Effectiveness Rating |

|---|---|---|---|

| Invoice Processing | Moderate to High | Format variations, multiple VAT rates, document quality | 70-85% |

| Receipt Handling | Low to Moderate | Inconsistent formats, physical handling, tax compliance | 40-60% |

| Bank Transaction Reconciliation | High | Integration limitations, handling exceptions | 80-95% |

| VAT Reporting | Moderate | Regulatory complexity, cross-border transactions | 65-80% |

| Financial Statements | Moderate | Complex compliance requirements, audit trail | 60-75% |

| Document Archiving | Moderate to High | GoBD compliance, long retention periods | 75-90% |

The most successful implementations combine multiple specialized solutions rather than relying on a single system. This approach allows businesses to select best-in-class tools for each process area while maintaining integration between systems.

Despite progress in recent years, several key areas still present significant opportunities for improvement in German bookkeeping automation:

Traditional OCR solutions struggle with the variety of invoice and receipt formats in the German market. Next-generation AI-powered solutions that can understand context, recognize German-specific formats, and adapt to new document layouts without manual programming represent a major opportunity for improvement.

Systems that automatically stay updated with the latest German tax regulations and accounting standards could significantly reduce compliance risks. Currently, many systems require manual updates or configuration changes when regulations change.

Many German businesses use multiple systems for different aspects of their operations. Improved integration between specialized accounting tools and other business systems (ERP, CRM, e-commerce platforms) would eliminate data silos and reduce manual data transfer tasks.

While enterprise-level solutions are well-developed, smaller businesses still face significant barriers to adoption including cost, complexity, and technical knowledge requirements. More affordable, user-friendly solutions specifically designed for small German businesses would drive broader automation adoption.

The next generation of bookkeeping automation in Germany is likely to be shaped by several emerging trends:

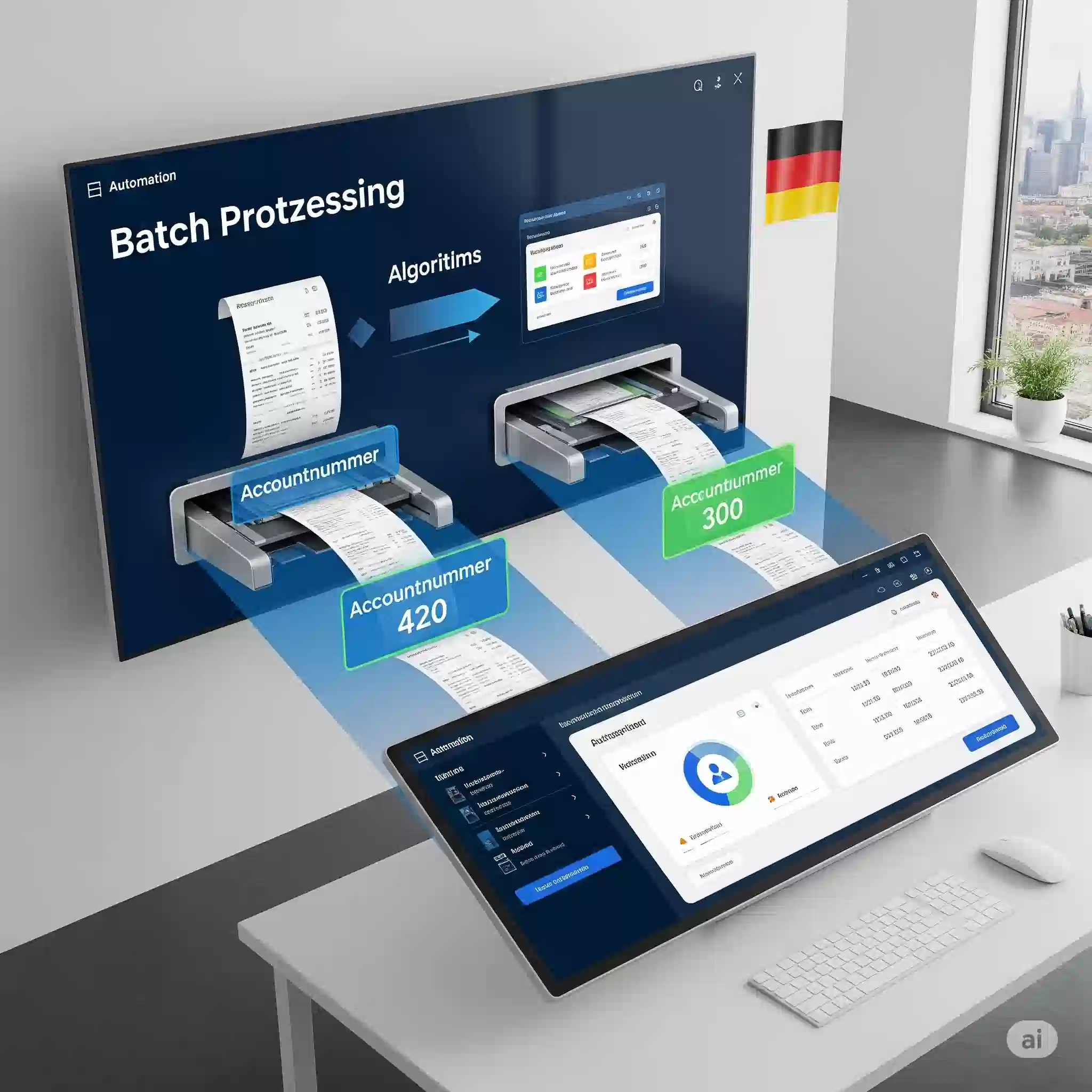

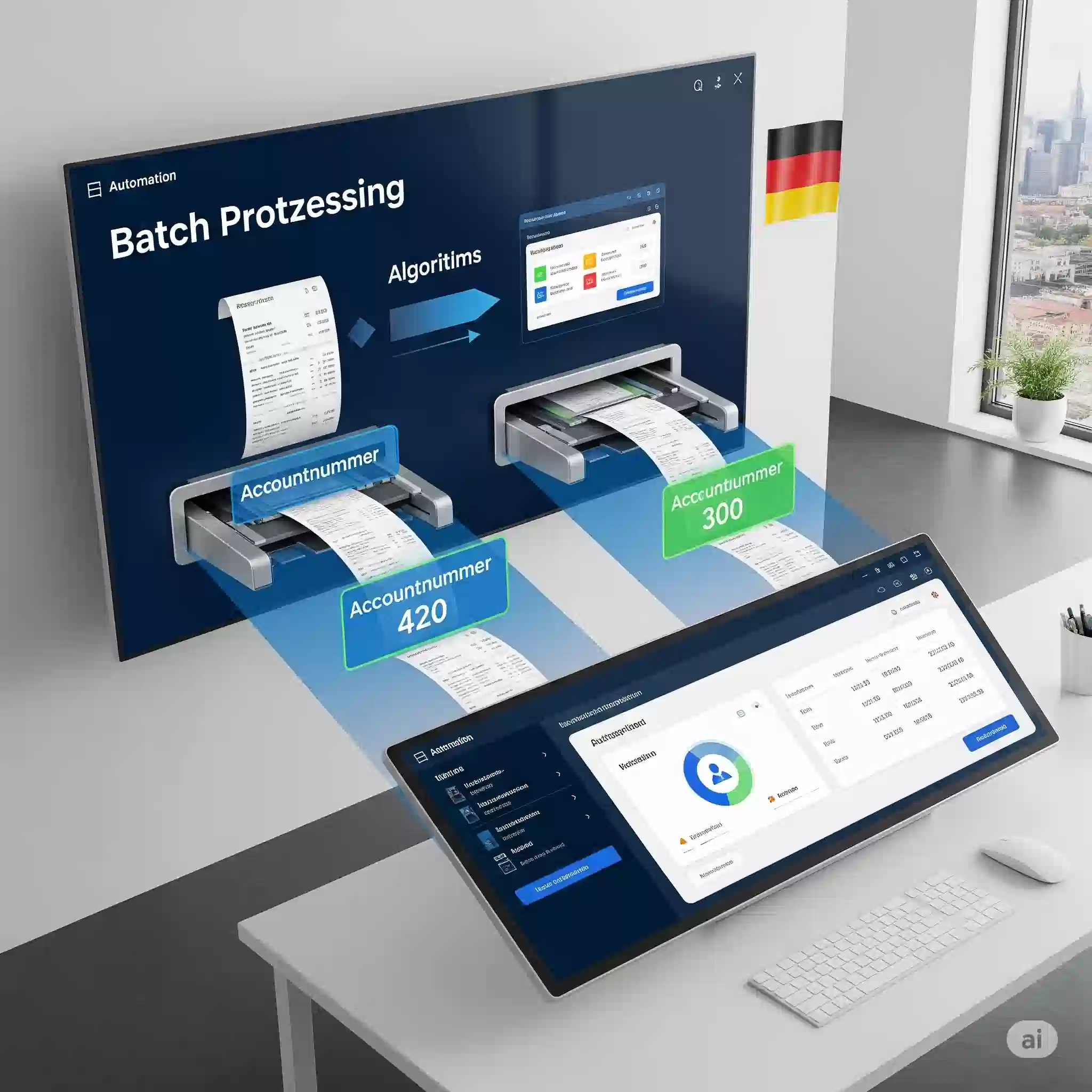

Advanced document processing platforms like Eagle Doc are transforming how businesses handle financial paperwork. By using sophisticated artificial intelligence models, these systems can accurately extract data from German invoices, receipts, and statements regardless of format variations.

Unlike traditional OCR solutions, AI-powered systems understand the context of financial documents, can identify German tax codes and rates, and improve their accuracy over time. This represents a significant advancement for businesses struggling with the document-heavy nature of German bookkeeping requirements.

Emerging solutions are beginning to offer real-time verification of transactions against German regulatory requirements, flagging potential compliance issues before they become problems. This proactive approach reduces audit risks and helps businesses maintain continuous compliance.

Blockchain technology is being explored for document verification and immutable audit trails, potentially transforming how businesses meet the strict documentation requirements of German tax authorities. This could provide a technological solution to the challenge of proving document authenticity and maintaining long-term records.

The future of bookkeeping in Germany lies at the intersection of advanced technology and regulatory compliance. As automated solutions continue to mature, businesses that embrace these technologies will gain significant advantages in efficiency, accuracy, and cost reduction while maintaining the high standards of German financial reporting.

The most successful approaches will combine specialized tools that excel in specific aspects of the bookkeeping workflow, with AI-powered document processing serving as a critical foundation for automating the paper-to-digital transition that remains challenging for many businesses.

For businesses looking to modernize their German bookkeeping processes, the key is selecting solutions that not only address the unique regulatory requirements of the German market but also deliver meaningful improvements in operational efficiency through intelligent automation.

Copyright © S2Tec GmbH